What to Do When Your Insurance Company Undervalues Your Roof Claim

Posted 10.09.2025 | 5 Minute Read

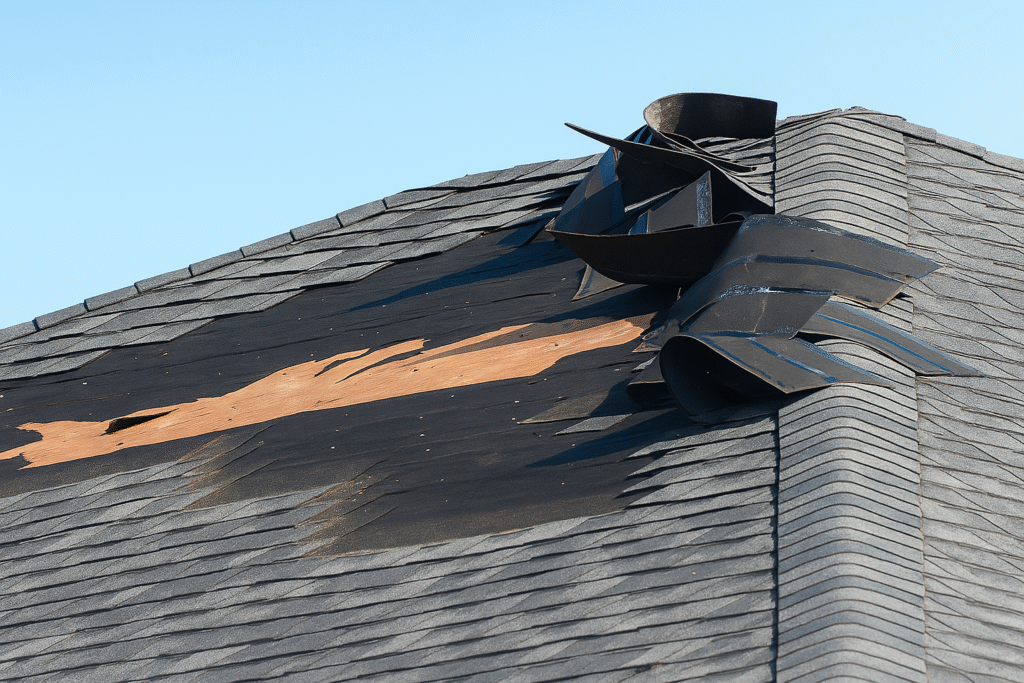

You filed a roof damage claim after a storm, but your insurance company’s offer won’t cover the repairs. Or worse, they denied your claim completely. It’s a frustrating situation that leaves many South Florida homeowners feeling stuck.

Fortunately, you have a good option: the insurance appraisal process. It’s a formal step designed to help you and your insurer reach a fair agreement on repair costs without going to court. This guide breaks down what it is, how it works, and how it can help you get the settlement you deserve.

What Is a Roof Insurance Appraisal?

Think of a roof insurance appraisal as an expert second opinion for your claim. This process is written into most homeowner policies as a way to resolve disagreements over the amount of loss. When you and your insurer can’t agree on the cost of repairs, either party can request an appraisal.

During an appraisal, independent experts evaluate the damage to determine the true cost of restoring your roof. It provides a clear path forward when your claim hits a roadblock.

When Should You Consider an Appraisal?

An appraisal is a valuable tool if your insurance company has:

- Denied your claim for what you believe is covered storm damage.

- Offered a settlement that is too low to cover the actual repair costs.

- Disagreed on the scope of work needed (e.g. repair vs. full replacement).

In South Florida, this scenario is common after hurricanes and severe tropical storms. Insurers may underestimate the extent of wind and water damage, leading to offers that fall short of what’s needed to meet local building codes and properly protect your home.

How Does the Roof Appraisal Process Work?

The appraisal process follows a clear, structured path. It begins when you or your insurer sends a formal written request to begin the process. From there, both you and your insurance company select your own independent appraiser. These two appraisers will then inspect your roof and create their own separate estimates for the repair costs.

If the two appraisers agree on the amount of loss, that figure becomes the binding settlement amount. If they disagree, they will work together to select a neutral, third-party umpire. The umpire reviews both estimates and the evidence to make a final decision. An agreement between any two of the three parties (your appraiser, the insurer’s appraiser, or the umpire) is binding for everyone involved.

How Long Does an Insurance Appraisal Take?

Most roof appraisals are completed within 30 to 90 days. Simple, straightforward cases can be resolved faster, while more complex disputes may take longer.

The timeline often depends on scheduling availability and how quickly appraisers can be selected. During a busy storm season in South Florida, the process can slow down as more homeowners require these services.

How Long Until Insurance Pays Your Roof Claim?

Once the appraisal process is complete and a settlement amount is determined, your insurance company typically issues payment within 10 to 30 days.

Florida law provides important protections for homeowners. Insurers are required to acknowledge a claim within 14 days and must pay or deny the claim within 90 days of receiving all necessary information. The time spent in the appraisal process is included within this 90-day window.

Pro-Tip: Good Documentation Is Key. Before the appraisal begins, gather all your documentation. Clear photos and videos of the damage, receipts for any temporary fixes (like tarps), and a detailed estimate from a trusted local roofer will give your appraiser the evidence they need to build a strong case for a fair settlement.

Who Pays for the Appraisal?

You are responsible for paying for your appraiser, and the insurance company pays for theirs. If an umpire is needed to resolve a disagreement, you and your insurer split that cost 50/50.

Hiring an appraiser can cost between $500 and $1,500, but it can be a worthwhile investment. If your claim was undervalued by thousands of dollars, the appraisal fee is a small price to pay to secure a fair and accurate settlement.

Can You Hire a Roofer During the Appraisal Process?

Yes, and getting a professional assessment early is a smart move. A qualified roofing contractor can provide a detailed estimate that identifies all storm-related damage. This report is a crucial piece of evidence for your appraiser.

You can and should also make emergency repairs to prevent further water intrusion. However, you should wait to sign a contract for a full roof replacement until after the appraisal has determined your final settlement amount.

What Happens After the Appraisal Is Over?

Once the appraisal award is finalized, the decision is binding, and your insurance company must pay the determined amount. With your settlement approved, you can move forward with hiring a licensed and insured roofing contractor to complete the repairs properly. Be sure to choose a company with extensive experience in storm damage and South Florida’s specific building codes.

Get the Support You Need for Your Roof Claim

The insurance appraisal process exists to protect you. If your insurance company has offered a low settlement or denied a legitimate claim, you don’t have to accept it.

At Coastal Roofing of South Florida, we’ve helped countless homeowners navigate the claims process to get a fair settlement after a storm. We provide detailed damage assessments that capture everything needed to restore your roof, and we can work alongside your appraiser to ensure nothing is overlooked.

Once your claim is settled, our expert team is ready to handle your roof repair or replacement with the quality and care your home deserves.

Schedule a free roof inspection today. We’ll provide an honest, no-pressure assessment and help you understand the best path forward for your roof and your claim.

Recent Articles