Florida PACE Program for Roof Financing Complete Guide

Posted 1.07.2026 | 8 Minute Read

When your roof needs replacement or major repairs, the cost can feel overwhelming. The good news is that the Florida PACE program offers a solution that lets you fund your roofing project with no money down and no credit check required. This government-backed financing option covers 100% of qualifying roof improvements, with fixed interest rates typically ranging from 6% to 8%.

Quick Answer: The Florida PACE program allows homeowners to finance roof replacements, repairs, and upgrades with zero down payment. Repayment happens through your property tax bill over time, making essential roofing work accessible even without perfect credit.

Whether you’re dealing with storm damage, aging shingles, or insurance requirements for roof updates, understanding your financing options can make the difference between delaying necessary work and protecting your home right away.

What is the Florida PACE Program

The Florida PACE program stands for Property Assessed Clean Energy, a financing mechanism created to help homeowners fund energy-efficient and hurricane-hardening improvements. Unlike traditional loans, PACE financing is tied to your property rather than your personal credit history.

This program emerged from Florida’s need to help residents prepare for severe weather while improving energy efficiency. Since its launch, thousands of Florida homeowners have used PACE funding to upgrade their roofs, install impact windows, and make other critical home improvements.

The key difference between PACE and other financing options lies in how you qualify and repay the loan. Instead of monthly payments to a lender, you pay through your annual property tax bill at a fixed rate. This structure makes roofing projects accessible to homeowners who might not qualify for traditional financing.

How PACE Roof Financing Works

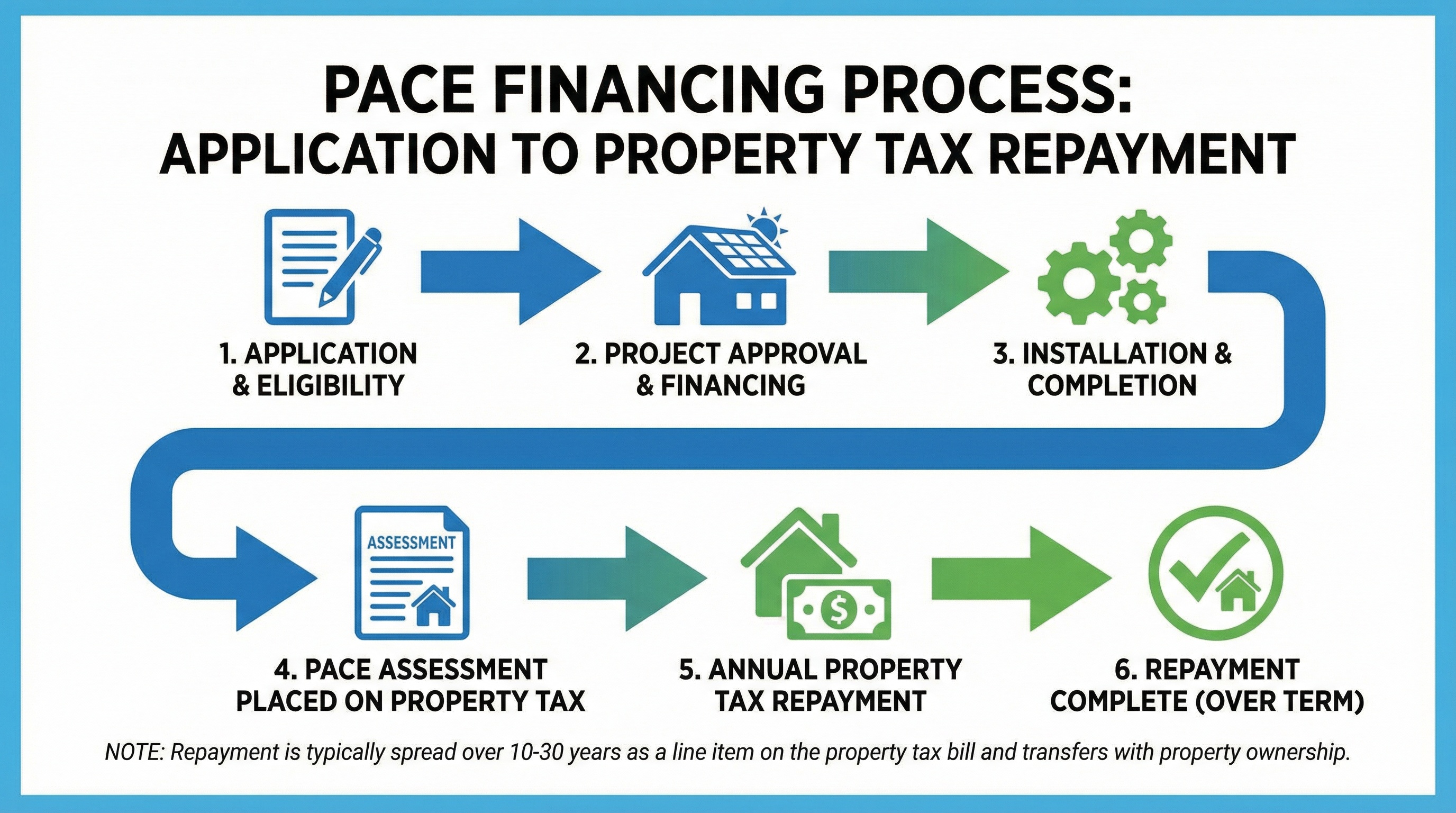

Getting PACE financing for your roof project follows a straightforward process that can often be completed in just a few days. Here’s how it works from start to finish.

First, you apply online or through a PACE-approved contractor. The application focuses on your property’s value and your ability to pay property taxes rather than your credit score. Most homeowners receive approval within 24 to 48 hours.

Once approved, you select your roofing contractor from PACE-approved providers or work with your preferred licensed roofer. The PACE program covers the full cost of qualifying roof work upfront, so you don’t need to pay anything out of pocket.

After your roofing project is completed to your satisfaction, PACE pays your contractor directly. You then begin repaying the financing through an assessment added to your property tax bill. This assessment continues for the agreed-upon term, which typically matches the useful life of your roof improvement.

Key Benefit: Unlike credit cards or personal loans, PACE financing offers fixed rates with no balloon payments or prepayment penalties, giving you predictable costs throughout the repayment period.

PACE Program Eligibility and Requirements

Qualifying for PACE financing involves meeting specific property and payment history requirements rather than credit score thresholds. Understanding these criteria helps you determine if PACE is right for your roofing project.

Your property must be current on all property taxes with no delinquencies in the past three years. Additionally, you need to be up to date on mortgage payments and have no notices of default during the previous three years. The program also requires that your property has no involuntary liens.

The financing amount cannot exceed 20% of your property’s assessed value without additional lender approval. This requirement ensures that the PACE assessment doesn’t create an excessive burden relative to your home’s worth.

Location matters too, as PACE financing is only available in counties and cities that have approved the program. According to floridapace.gov, many Florida counties now participate, but you’ll need to verify availability in your specific area before applying.

Your income must demonstrate the ability to handle the additional property tax assessment. While there’s no minimum credit score requirement, PACE providers do evaluate your capacity to make the ongoing payments through your property taxes.

Qualifying Roof Improvements and Interest Rates

The Florida PACE program covers a comprehensive range of roofing projects that improve your home’s energy efficiency, storm resistance, or overall condition. Most common roofing needs qualify for this financing option.

Roof replacements represent the most frequent use of PACE funding, especially when insurance companies require updates for policy renewals. The program also covers roof repairs, insulation upgrades, cool roofing installations, and energy-efficient materials that reduce your home’s cooling costs.

Additional qualifying improvements include skylight installation, gutter and drainage system upgrades, attic ventilation improvements, and emergency roofing services after storm damage. These projects often provide both immediate protection and long-term energy savings.

| Financing Option | Interest Rate | Down Payment | Credit Check |

|---|---|---|---|

| PACE Program | 6% – 12.99% | $0 | No |

| HELOC | 8.5% – 15.37% | Varies | Yes |

| Credit Cards | 18% – 24% | $0 | Yes |

Interest rates for PACE financing typically fall between 6% and 12.99%, with most homeowners securing rates in the 6% to 8% range. These rates remain fixed throughout your repayment term, providing predictable costs that help with long-term budgeting.

Cost Comparison: PACE rates are significantly lower than credit card financing and often more accessible than HELOCs, making them an attractive middle ground for roof financing.

PACE vs Other Roof Financing Options

When comparing financing options for your roof project, each method offers different advantages and limitations. Understanding these differences helps you choose the best approach for your situation.

Traditional home equity lines of credit often provide the lowest interest rates but require excellent credit and significant home equity. The approval process can take weeks, which doesn’t help when you need immediate roof repairs after storm damage.

Contractor financing through roofing companies may offer promotional rates or deferred payment options. However, these programs typically require good credit and may include higher long-term costs if promotional periods expire. For a comprehensive overview of all available options, explore the best roof replacement financing in Florida 2026.

Credit card financing provides immediate access to funds but comes with much higher interest rates. For major roof projects costing $15,000 or more, credit card interest can add thousands to your total cost.

PACE financing bridges these gaps by offering reasonable rates without credit requirements, immediate approval, and the flexibility to choose your preferred contractor. The property tax repayment method also means the financing can transfer to new owners if you sell your home, though this requires buyer agreement.

The main consideration with PACE is that it creates a lien on your property, similar to a HELOC. This means consistent payment is essential to avoid potential complications with your property ownership.

Understanding your financing options ensures you can move forward with necessary roof work without compromising your financial stability. The Florida PACE program provides a valuable alternative that makes essential home improvements accessible to more homeowners, regardless of their credit history. Whether you’re dealing with insurance requirements, storm damage, or simply an aging roof, PACE financing can help you protect your home and family without the stress of large upfront costs.

Before committing to any financing option, it’s important to understand what’s covered under your roofing warranties and how different financing programs in Florida compare in terms of long-term value and protection for your investment.